Below are the T accounts with the journal entries already posted. We’ll use a company called MacroAuto that creates and installs specialized exhaust systems for race cars. Here are MacroAuto’s accounting records simplified, using positive numbers for increases and negative numbers for decreases instead of debits and credits in order to save room and to get a higher-level view. Closing entries are crucial for maintaining accurate financial records. HighRadius has a comprehensive Record to Report suite that revolutionizes your accounting processes, making them more efficient and accurate.

Explore our full suite of Finance Automation capabilities

A temporary account is an income statement account, dividend account or drawings account. It is temporary because it lasts only for the accounting period. At the end of the accounting period, the balance is transferred to the retained earnings account, and the account is closed with a zero balance. For each temporary account there will be a closing journal entry.

- This ledger is used to record all transactions over the specific accounting period in question.

- They are also transparent with their internal trial balances in several key government offices.

- Interim periods are usually monthly, quarterly, or half-yearly.

- It isimportant to understand retained earnings is not closed out, it is only updated.

- In other words, the income and expense accounts are “restarted”.

Step 3: Close Income Summary to the appropriate capital account

Temporary accounts are used to accumulate income statement activity during a reporting period. The use of closing entries resets the temporary accounts to begin accumulating apps new transactions in the next period. Otherwise, the balances in these accounts would be incorrectly included in the totals for the following reporting period.

Monthly Financial Reporting Template for CFOs

The income summary account is then closed to the retained earnings account. In essence, we are updating the capital balance and resetting all temporary account balances. When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings. Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry.

What are the transactions made at the end of an accounting period?

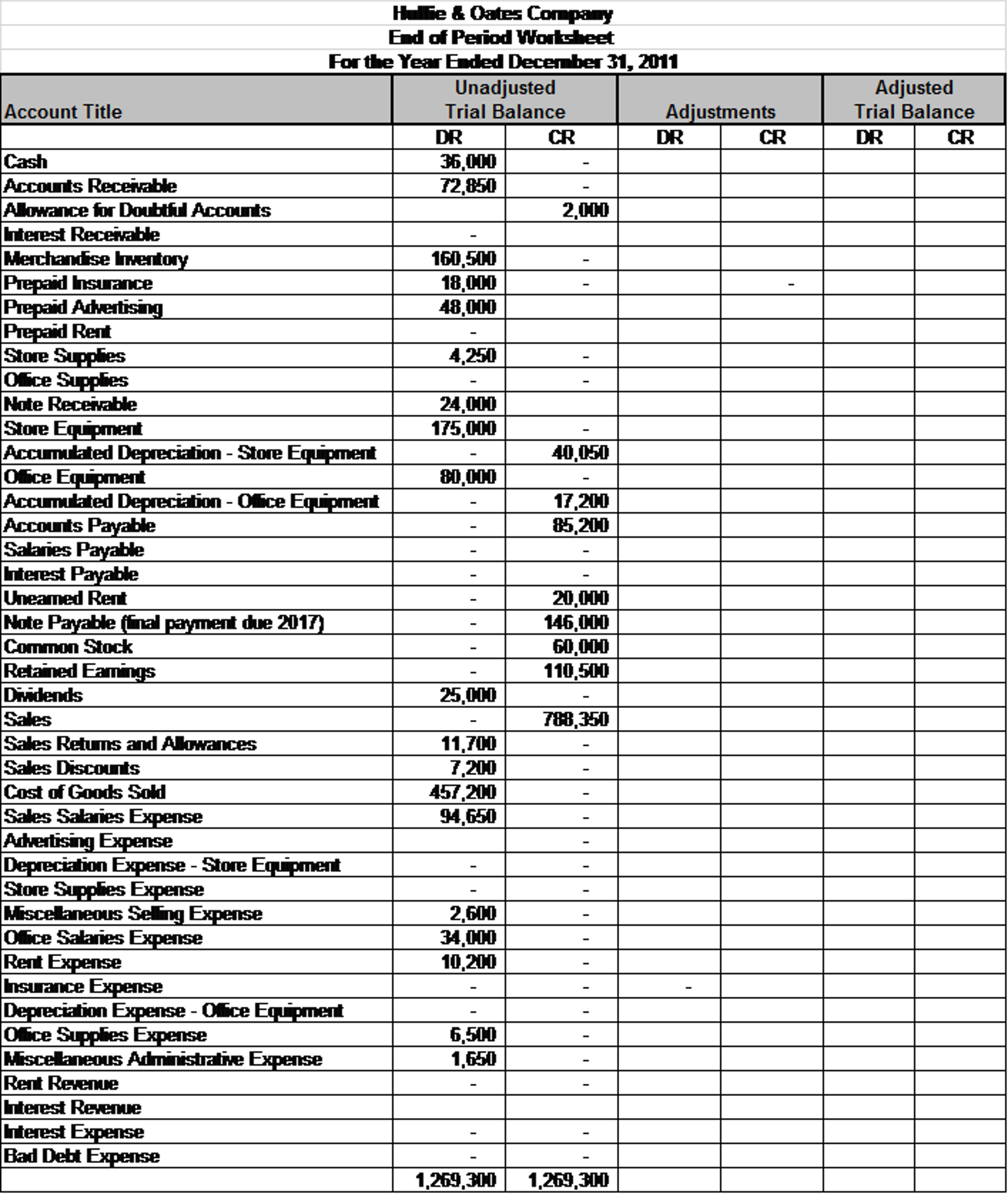

The Printing Plus adjusted trial balance for January 31, 2019, is presented in Figure 5.4. State whether each account is a permanent or temporary account. It is the end of the year, December 31, 2018, and you are reviewing your financials for the entire year. You see that you earned $120,000 this year in revenue and had expenses for rent, electricity, cable, internet, gas, and food that totaled $70,000.

To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement. Instead, the basic closing step is to access an option in the software to close the reporting period. Doing so automatically populates the retained earnings account for you, and prevents any further transactions from being recorded in the system for the period that has been closed.

The net income (NI) is moved into retained earnings on the balance sheet as part of the closing entry process. The assumption is that all income from the company in one year is held for future use. One such expense that’s determined at the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors. Temporary accounts are used to record accounting activity during a specific period.

Examples are cash, accounts receivable, accounts payable, and retained earnings. These accounts carry their ending balances into the next accounting period and are not reset to zero. This process ensures that your temporary accounts are properly closed out sequentially, and the relevant balances are transferred to the income summary and ultimately to the retained earnings account.

Notice that the effect of this closing journal entry is to credit the retained earnings account with the amount of 1,400 representing the net income (revenue – expenses) of the business for the accounting period. The second entry requires expense accounts close to the IncomeSummary account. To further clarify this concept, balances are closed to assureall revenues and expenses are recorded in the proper period andthen start over the following period. Closing entries are a necessary part of the accounting cycle as they allow businesses to generate financial statements and file tax returns every month and year accurately.

If dividends are declared, to get a zero balance in the Dividends account, the entry will show a credit to Dividends and a debit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to the declaration and payment of dividends. The first part is the date of declaration, which creates the obligation or liability to pay the dividend. The second part is the date of record that determines who receives the dividends, and the third part is the date of payment, which is the date that payments are made. Printing Plus has $100 of dividends with a debit balance on the adjusted trial balance. The closing entry will credit Dividends and debit Retained Earnings.