The accounts that need to start with a clean or $0 balance going into the next accounting period are revenue, income, and any dividends from January 2019. To determine the income (profit or loss) from the month of January, the store needs to close the income statement information from January 2019. We see from the adjusted trial balance that our revenue account has a credit balance.

What is the Closing Procedure in Accounting?

Our program is specifically developed for you to easily set up your closing process and initiate book closing within seconds – no prior technical knowledge necessary. Now, the income summary account has a zero balance, whereas net income for the year ended appears as an increase (or credit) of $14,750. Now that we know the basics of closing entries, in theory, let’s go over the step-by-step process of the entire closing procedure through a practical business example. After most of the cycle is completed and financial statements are generated, there’s one last step in the process known as closing your books.

Permanent versus Temporary Accounts

Revenue, expense, and dividend accounts affect retained earnings and are closed so they can accumulate new balances in the next period, which is an application of the time period assumption. In short, we can clear all temporary accounts to retained earnings with a single closing entry. By debiting the revenue account and crediting the dividend and expense accounts, the balance of $3,450,000 is credited to retained earnings.

How to Record a Closing Entry

You might be asking yourself, “is the Income Summary account even necessary? ” Could we just close out revenues and expenses directly into retained earnings and not have this extra temporary account? We could do this, but by having the Income Summary account, you get a balance for net income a second time. This gives you the balance to compare to the income statement, and allows you to double check that all income statement accounts are closed and have correct amounts. If you put the revenues and expenses directly into retained earnings, you will not see that check figure. No matter which way you choose to close, the same final balance is in retained earnings.

Retained earnings are defined as a portion of a business’s profits that isn’t paid out to shareholders but is rather reserved to meet ongoing expenses of operation. Expert advice and resources for today’s accounting professionals. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Now, it’s time to close the income summary to the retained earnings (since we’re dealing with a company, not a small business or sole proprietorship). This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Summary. Now for this step, we need to get the balance of the Income Summary account.

- Temporary accounts are used to accumulate income statement activity during a reporting period.

- All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary.

- It is permanent because it is not closed at the end of each accounting period.

- A sole proprietor or partnership often uses a separate drawings account to record withdrawals of cash by the owners.

- You will notice that wedo not cover step 10, reversing entries.

- The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data.

The purpose of closing entries is to merge your accounts so you can determine your retained earnings. Retained earnings represent the amount your business owns after paying expenses and dividends for a specific time period. As the drawings account is a contra equity account and not an expense account, it is closed to the capital account and not the income summary or retained earnings account. After the closing journal entry, the balance on the dividend account is zero, and the retained earnings account has been reduced by 200. At the end of the year, all the temporary accounts must be closed or reset, so the beginning of the following year will have a clean balance to start with. In other words, revenue, expense, and withdrawal accounts always have a zero balance at the start of the year because they are always closed at the end of the previous year.

They’d record declarations by debiting Dividends Payable and crediting Dividends. If this is the case, then this temporary dividends account needs to be closed at the end of the period to the capital account, Retained Earnings. In a sole proprietorship, a drawing account is maintained to record 15 tax deductions and benefits for the self all withdrawals made by the owner. In a partnership, a drawing account is maintained for each partner. All drawing accounts are closed to the respective capital accounts at the end of the accounting period. An accounting period is any duration of time that’s covered by financial statements.

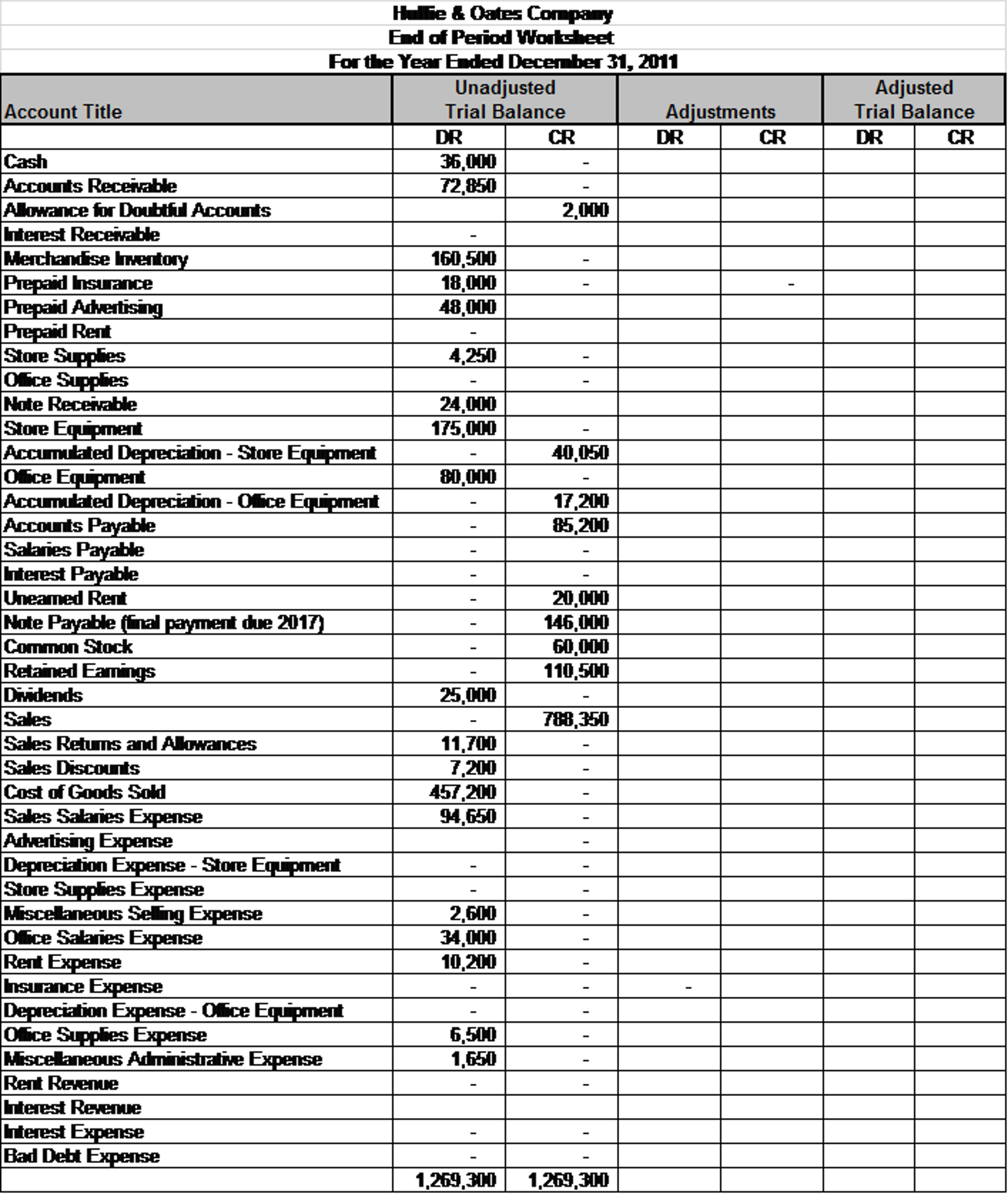

However, you might wonder, where are the revenue, expense, and dividend accounts? These accounts were reset to zero at the end of the previous year to start afresh. On expanding the view of the opening trial balance snapshot, we can view them as temporary accounts, as can be seen in the snapshot below.

Notice how only the balance in retained earnings has changed and it now matches what was reported as ending retained earnings in the statement of retained earnings and the balance sheet. Prepare the closing entries for Frasker Corp. using the adjusted trial balance provided. The fourth entry requires Dividends to close to the Retained Earnings account. Remember from your past studies that dividends are not expenses, such as salaries paid to your employees or staff.